Protect Your Retirement With True Wealth

Invest In Gold Today

Gold Is A Portfolio Diversifier

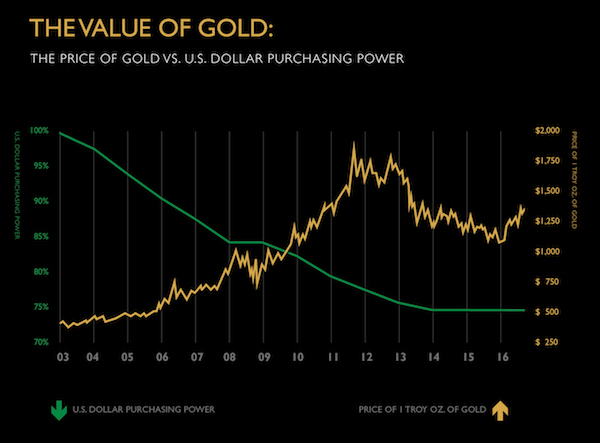

In a post-Great Recession world, alternative asset classes are emerging as a vital component in financial portfolios, mainly in the form of precious metals. Gold is especially regarded for its negative correlation to stocks and bonds. Historically, when stocks go down, gold goes up. This makes it an ideal portfolio diversifier during times of unexpected economic downturns.

Foundation For Longeterm Wealth

Gold has maintained an intrinsic value for thousands of years, making it a unique vehicle for wealth insurance. As the only global currency that has stood the test of time, gold has outlasted every government and paper form of money—making it essentially default proof. As a long-held form of wealth preservation, protect what you’ve earned and saved throughout the years with physical gold.

Protection From The Volatile Stock Market

When the stock market tumbles, even the so-called “safest” mutual funds and bonds can take a hit, and retirement accounts can suffer greatly. If it happens to you right before retirement (as it did to many during the Great Recession), you could be forced to continue working for many years to come. Diversifying your portfolio with precious metals helps protect your retirement money by shielding it from the volatility associated with stocks and other paper assets.